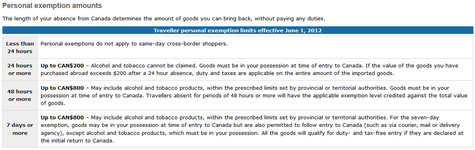

Less than 24 hours Personal exemptions do not apply to same-day cross-border shoppers.

24 hours or more Up to CAN$200 – Alcohol and tobacco cannot be claimed. Goods must be in your possession at time of entry to Canada. If the value of the goods you have purchased abroad exceeds $200 after a 24 hour absence, duty and taxes are applicable on the entire amount of the imported goods.

48 hours or more Up to CAN$800 – May include alcohol and tobacco products, within the prescribed limits set by provincial or territorial authorities. Goods must be in your possession at time of entry to Canada. Travellers absent for periods of 48 hours or more will have the applicable exemption level credited against the total value of goods.

7 days or more Up to CAN$800 – May include alcohol and tobacco products, within the prescribed limits set by provincial or territorial authorities. For the seven-day exemption, goods may be in your possession at time of entry to Canada but are also permitted to follow entry to Canada (such as via courier, mail or delivery agency), except alcohol and tobacco products, which must be in your possession. All the goods will qualify for duty- and tax-free entry if they are declared at the initial return to Canada.

Source:

http://www.cbsa-asfc.gc.ca/travel-voyage/ifcrc-rpcrc-eng.html

I can't imagine what you bring into the U.S. making any difference on the limit when you come back.

Note these limits are in CAD, not USD.